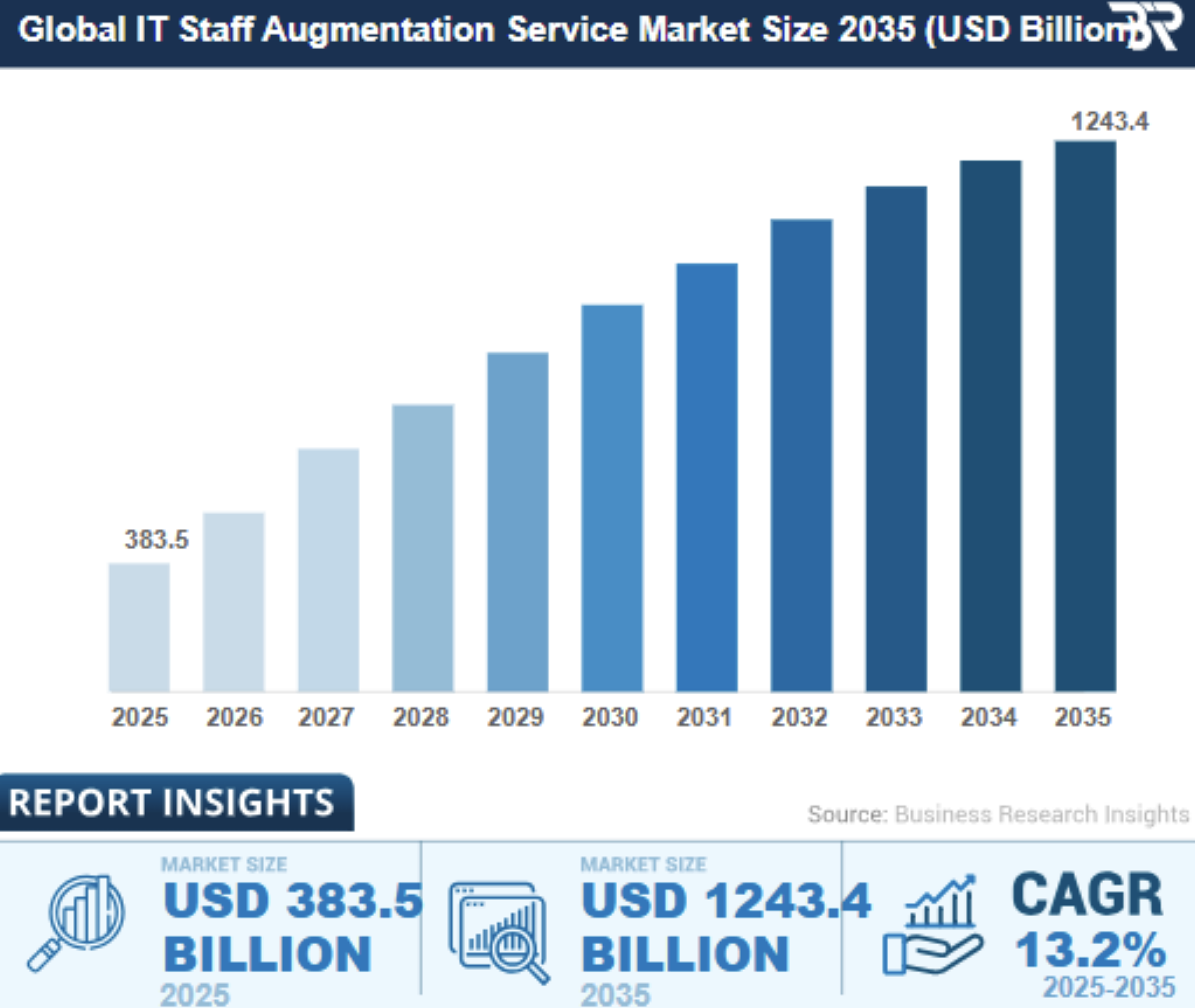

Spending on IT staff augmentation passed $383 billion in 2025 and is projected to keep climbing as organizations race to deploy AI, cloud, and cybersecurity initiatives faster than in-house hiring can support.

Image by Business Research Insights.

At the same time, hybrid work is no longer an experiment; it is the default for distributed product teams. That combination of explosive skills demand plus remote-ready processes makes 2026 the most competitive market yet for midsize augmentation partners.

Selecting the right vendor is therefore a strategic move, not a procurement afterthought. The eight firms below have been vetted for size (all are roughly the same size as or smaller than Newxel, avoiding the "too-big-to-care" syndrome), transparency, and their ability to deliver production-ready talent in weeks rather than months.

How We Picked the Winners

Selecting an augmentation partner is not unlike choosing a co-founder for your next product cycle - vision, reliability, and cultural fit all matter. With that in mind, we applied the following primary filters:

- Company Size: < 500 engineers to ensure clients receive leadership access and flexible terms.

- Service Focus: Core business is IT staff augmentation or dedicated team building.

- Track Record: Minimum five years in operation and public case studies.

- Global Hiring Reach: Ability to source talent from more than one geography.

- Operational Transparency: Transparent pricing or governance models available on their sites or in public reviews.

From there, we went deeper. We weighed each vendor's developer-retention metrics, average time-to-hire, and breadth of senior-level specialists. We looked for evidence of proactive knowledge sharing, like blogs, open-source contributions, and conference talks, as a proxy for engineering maturity. Client references were double-checked against independent review platforms to rule out marketing hyperbole. Finally, we interviewed delivery managers to understand escalation paths and cultural compatibility. Only IT staff augmentation firms scoring at least 8/10 across these qualitative criteria earned a spot on the final list, which explains why some well-known names did not make the cut for larger headcounts.

1. Newxel - The "Turnkey" Growth Partner

Headquarters: Kyiv, Ukraine | Size: ~500 developers

Newxel is the IT staff augmentation company that tops the list for one simple reason: it genuinely acts as a one-stop shop. With more than 500 developers across 11 countries, Newxel helps clients spin up complete R&D centers or single-specialist pods in as little as three to five weeks. What sets them apart is the depth of back-office coverage. Recruiting, HR, payroll, legal, workspace, and even branded office setup come bundled, so CTOs can manage product roadmaps instead of hunting for payroll providers in unfamiliar jurisdictions.

Clients typically start with staff augmentation and later graduate to a dedicated or distributed team under the same contractual umbrella. This pathway lets scale-ups pilot remote delivery with minimal risk, then lock in a long-term workforce once market traction is proven. A 98 percent developer-retention figure shows the approach works. For organizations that need both speed and continuity - think fintech, deep-tech SaaS, or complex embedded projects - Newxel is a compelling first call.

2. EffectiveSoft - Healthcare and Fintech Depth on a Mid-Size Footprint

Headquarters: San Diego, USA / San Jose, Costa Rica | Size: 300+ engineers

Founded in 2000, EffectiveSoft focuses on software that must pass audits the first time. Sixty percent of its projects involve HIPAA, FHIR, or PCI-DSS, so recruiters target developers fluent in compliance jargon. With fewer than 400 employees, clients still meet a co-founder during discovery, yet delivery centers supply overlap for both U.S. and EU time zones. Internal Clutch data shows an average tenure of 4.7 years, helping teams retain context across long roadmaps. Each augmentation deal includes a "shadow sprint," placing a backup engineer on standby for two weeks - an inexpensive guardrail against holiday or sick-day surprises. Teams also offer optional 24/7 production support.

3. Mphasis - Enterprise Pods Without Enterprise Drag

Headquarters: Bengaluru, India / New York, USA | Size : 37000 employees

To avoid "too big to care" syndrome, Mphasis carved a 500-person Talent Pods division out of its 45,000-employee empire. The unit operates a separate P&L, allowing operators to offer in hours rather than weeks. An AI-driven matching engine filters résumés by skill tags, domain badges, and DISC profile, so clients see three aligned candidates within ten business days. Staff sit in Bengaluru, Guadalajara, and Toronto, enabling hand-offs that keep stories moving 24/7 while still hitting U.S. stand-ups. Because the parent company is ISO 27001 and SOC 2 certified, Pods inherit enterprise-grade controls for data rooms and VPNs. Scale-ups that want Fortune-100 security without Fortune-100 bureaucracy find Mphasis a comfortable middle ground. Kubernetes guardrails ship pre-configured for every deployment.

4. Tecla - Plug-and-Play Latin-American Engineers

Headquarters: Seattle, Washington, USA | Size: 100+ experts in AI, Cloud, DevOps, 50,000 vetted freelancers

Tecla operates a subscription marketplace: candidates complete English tests, live coding sessions, and culture interviews before their profiles go live. When a CTO posts a role, the platform typically produces a shortlist in 48 hours and a signed offer in seven days, the fastest in our survey. Developers span 15 Latin American countries, enabling U.S. clients to collaborate in the same time zone without Silicon Valley payrolls. Fees are transparent, so finance teams forecast burn cleanly. For extra stability, Tecla keeps a small bench of salaried "rapid responders" that can jump into a sprint if a freelancer drops out mid-cycle. Seed and Series-A companies appreciate the contingency plan as much as the speed. Tax withholding and local perks are handled automatically.

5. Softjourn - Ticketing and Payments Specialists

Headquarters: Ivano-Frankivsk, Ukraine / Fremont, USA | Size: 200 engineers

Softjourn's engineers live and breathe two domains: live-event ticketing and digital payments. That focus means new hires arrive already knowing seat maps, chargebacks, interchange fees, and PSD2. All augmentation contracts bundle DevOps support: Kubernetes clusters spin up in Softjourn's ISO-27017 sandbox, then migrate to the client's cloud, saving at least one sprint of infrastructure yak-shaving. Delivery happens from Ukraine and Poland, providing overlap for both coasts of the United States. A published 94 percent annual retention rate keeps brain drain low on long initiatives such as wallet rebuilds or venue redesigns. Payment gateway stubs significantly accelerate QA cycles.

6. Rootstack - Nearshore Agility from Panama

Headquarters: Panama City, Panama | Size: 200 engineers

Panama's dollar economy and GDPR-aligned data laws make Rootstack an attractive bridge for U.S. fintech and health-tech firms. The company enforces a strict 1:8 project-manager-to-developer ratio, posted on its website for anyone to audit, a transparency few rivals match. Engineering centers in Bogotá and Monterrey complement the Panama HQ, letting squads cover EST through PST without graveyard shifts. Core stacks are Java/Spring, Python/FastAPI, and React, so Rootstack fits naturally into microservice back ends and modern front ends. Because Panama sits on Central Time, daily stand-ups feel in-house rather than offshore. Each engagement begins with a free architecture audit.

7. OnHires LATAM - Subscription Recruiting for Hypergrowth

Headquarters: Sheridan, USA | Size: 200+ employees, 130,000-engineer talent cloud

OnHires LATAM borrows Spotify's "squad" idea for recruiting. Clients pay a monthly subscription that unlocks unlimited candidate flow plus local employer-of-record paperwork when they decide to hire. In 2025, the median fill time for senior engineers was 3.2 weeks. Because every recruiter is native to the region, they tap Slack channels and university meetups that U.S. LinkedIn ads miss. The model is ideal for founders planning bursts - ten hires this quarter, perhaps none next - because they can ramp the subscription up or down without hefty placement fees. Y Combinator alumni in Mexico City and São Paulo praise OnHires for replacing an internal talent-acquisition team at half the cost. Weekly dashboards expose funnel metrics in real time.

8. Netguru - Design-Led Engineering at Polish Scale

Headquarters: Poznań, Poland | Size (Augmentation Guild): 600+ employees, or 900+ people on board

Netguru started as a top European design studio and still moves pixels with award-winning precision, but today nearly five hundred engineers sit in its dedicated Augmentation Guild. Each pod can add an optional "UX steward," a part-time designer who audits user flows every sprint and drops Figma tweaks before code freeze. The tech stack spans Ruby on Rails, Node.js, TypeScript, and Flutter, with 70 percent of 2025 bookings including at least one AI recommendation feature delivered on Google Cloud Vertex. The company is ISO 27001 certified and fully remote, yet founders join quarterly reviews, keeping engagement personable. Dedicated accessibility experts ensure WCAG compliance by default.

Conclusion

The eight IT staff-augmentation companies above share several success traits: manageable size, laser focus on engineering services, and a healthy respect for retention best practices. Yet each brings its own flavor – be that Newxel's turnkey operations, Netguru's design stewardship, or Softjourn's ticketing/payment depth.

When choosing among them, match your priority to the vendor DNA:

- Need to spin up a full offshore R&D hub fast? Newxel.

- Regulated healthcare or fintech compliance headaches? EffectiveSoft.

- Enterprise-grade security controls without big-vendor drag? Mphasis.

- Want lightning-fast, same-time-zone hiring? Tecla.

- Prefer nearshore squads with transparent governance? Rootstack.

- Planning a ten-seat hiring burst on subscription terms? OnHires LATAM.

- Demand pixel-perfect UX baked into agile sprints? Netguru.

- Building event-ticketing, payment, or media platforms? Softjourn.

Finally, remember that augmentation is a partnership, not a transaction. Take the time to do onboarding rituals, keep feedback loops short, and make sure that remote engineers feel like they are really part of the mission. If you do that, you'll look back on this vendor choice as the thing that kept your roadmap on track while your competitors were still writing job ads at the end of 2026.

Featured Image generated by Google Gemini.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment