Today, accurate payroll is a concern for businesses of all sizes. Human and technical errors are often hard to spot and can result in payroll errors, which can then lead to litigation.

This challenge has rendered the online paystub maker a practical tool for accurate payroll management. This article discusses online paystub makers and how they help maintain the accuracy of your business payroll.

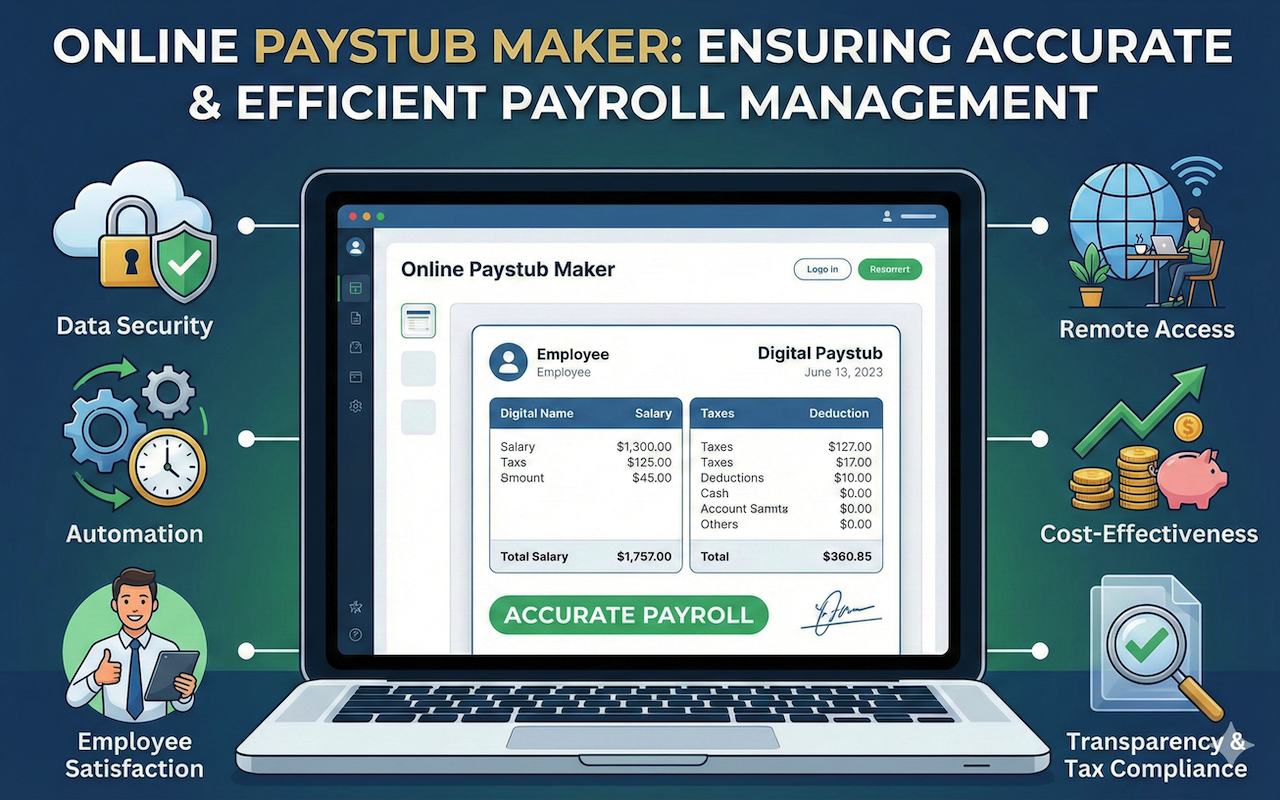

Automatization of Payroll Processes through Paystub Maker

The online paystub maker, by calculating what the business pays its workforce, saves HR professionals and bookkeepers a lot of precious time. Calculating wages, deductions, and withholdings is particularly susceptible to human error. A paystub generator automates these processes and produces accurate results. Because of this, the HR professionals can focus on other administrative tasks that matter more.

Paystub Maker’s Accuracy Increases Employee Satisfaction

Paystubs are a big part of keeping your employees satisfied. Employees must trust their employers to be able to work for them fully motivated. Online paystub makers automatically calculate everything and ensure employees are paid the correct amount. The tool enables a better employee-employer relationship that is built on trust and transparency.

Ensure Accurate Tax Compliance with Paystub Makers Online

It is imperative that business owners are well aware of how to comply with current laws and tax provisions. However, sometimes, tax provisions can be very dynamic. Therefore, your business owner may not always be aware of the changing rules and regulations. Using an online paystub maker can help avoid legal penalties and an IRS audit. Relying on this tool can help business owners feel more at ease.

Facilitating Remote Access through Online Paystub Makers

Especially with remote work becoming the new norm, having access to payroll information from anywhere is effective. Online pay stub makers allow employees and employers to retrieve pay stubs from anywhere in the world. It also enhances convenience and allows a flexible work style.

Achieve Cost-Effectiveness with Online Paystub Maker

Wondering if an online paystub maker can help you save money? They absolutely can. They reduce effort by automating the process, thereby reducing the risk of errors. This saves organizations from making costly payroll management mistakes. This efficiency also translates to savings in expenditures as companies do not spend extra on hiring labor. An online pay stub maker is perfect for organizations looking to save on overall expenses.

Online Paystub Makers Ensure Data Security

For an organization managing sensitive information, data security is paramount. Online paystub generators use encryption and secure servers to prevent unauthorized access to an employee's information. It also protects your private and financial information from being exposed.

Enhancing Transparency with Paystub Makers

Transparent payroll processes in an organization build trust. These online paystub makers provide a detailed breakdown of salary components, deductions, taxes, etc., in a much simpler way. As a result, employees achieve a better understanding of their paychecks. This eliminates any doubts or questions about the payout.

Businesses Need to Adapt to Technological Advancements

As the years pass and technology shifts, businesses must become more advanced and adopt new technologies to ease their operations. It also widens the horizon for the online paystub tool. Regular updates keep these tools relevant and practical. Organizations switching to these solutions will be more robust by leveraging the advanced technology available in the market.

Conclusion

Online paystub makers ensure payroll information is accurate. These tools offer many benefits to companies, such as automated calculations, reduced risk of compliance breaches, and greater transparency. Their goal is to help improve the workplace with a seamless, cost-effective, and secure payroll process. By adopting these solutions, companies can expect a higher employee satisfaction level and better operational efficiency.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute legal, financial, tax, or professional advice. While efforts are made to ensure accuracy, payroll laws, tax regulations, and compliance requirements may vary by jurisdiction and are subject to change.

Readers are encouraged to consult qualified professionals or official regulatory sources before making payroll, tax, or compliance-related decisions. Any references to third-party tools, services, or external websites are provided for informational purposes only. iplocation.net does not control, endorse, or assume responsibility for the content, accuracy, or availability of external links and is not liable for any damages or losses arising from their use.

Featured Image generated by Google Gemini.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment