Keeping track of your expenses can make your life easier, as effective financial management is critical to achieving your financial stability. By tracking your spending, you can easily identify where you can save and learn how to make informed decisions about where to invest and how to distribute money. It can help you forget the "how to borrow money from cash app" problem. For some reason, this seems like a daunting task for many, but in this article, we will look at some useful tips to help you properly track where you spend your savings.

First, you should check where and why you are spending your income. There are two types of expenses: fixed and variable. Fixed expenses, such as mortgage or rent, utility bills, insurance, etc., occur monthly. In this type, saving on something is quite difficult, so let's move on to variable expenses. It is usually your spending on food, clothes, and travel. In this type, you have many more opportunities to adjust your expenses.

6 Steps to Help You Start Tracking Your Monthly Expenses

Step 1: Before you start tracking your expenses, you need to have a budget in place. It is important to note that you control the budget, not him, so first, we will set up our budget. First, we will calculate how much we will earn this month. Add it all up, and you have your monthly income.

If you do not have a permanent job, do not despair. Just calculate the amount you earned in the past month, which will be your approximate monthly income. Now the crucial moment has come, you need to distribute the money. Where and how much you spend next month depends only on you, but I would advise you to manage your money in the following order:

- Donations (10% of salary)

- Nourishment, essential services, housing, and conveyance

- Other essentials (insurance, debts, etc.)

- Entertainment, restaurants, travel, etc.

Step 2: It's a good idea to collect your financial records. Financial records refer to any documentation that contains information about your financial transactions. These records can include bank statements, credit card statements, receipts, invoices, tax forms, or other financial documents that track your income and expenses. Financial records are important because they help you keep track of your money, understand your spending patterns, and make informed financial decisions.

Step 3: The next important task is to choose a method for tracking expenses. I can offer several methods that could help you to track your expenses:

- Spreadsheet: You can create a spreadsheet in Microsoft Excel or Google Sheets in which you enter your income and list expenses in separate columns that you update frequently.

- Pen and notebook: You can also safely calculate and write down all your income in one small notebook, in which you classify all your expenses accordingly.

- Budgeting apps: This is a great alternative for people who don't like spreadsheets and notepads. Some popular budgeting apps are Mint and Personal Capital.

- The last thing we'll look at is the envelope system. You buy several envelopes and sign them according to your previously compiled categories, such as food, entertainment, utility bills, etc. This method is suitable for those who prefer to use cash.

Step 4: Record your expenses as they occur, ensuring that you include the date, the amount spent, and the category of the expense. This will help you to track your spending and stay within your budget.

Step 5: Setting financial goals can improve your skills in controlling your finances and working towards achieving your long-term financial objectives. Make your goals specific and measurable so you know exactly what you want to achieve and track your progress.

Setting a timeline will increase your chances of staying motivated and focused more of the time. Celebrate your achievements. It's always good to celebrate even the smallest victories.

Step 6: If you find that you can't fit into the amount you need and don't have enough funds for any of your areas, just adjust your budget. It's not bad when you change something in your plan, not everyone succeeds in correctly allocating money to certain areas the first time, so don't be discouraged and just keep doing it.

Why Should You Track Your Expenses?

There are several benefits to tracking expenses that simply cannot be ignored. First of all, Identifying spending patterns. Tracking your expenses allows you to identify patterns in your spending habits and identify areas where you can make changes to reduce your expenses.

Also, when you learn to control your spending, you will become more aware of your habits and be able to make informed decisions about how to distribute money. Keeping track of your expenses prepares you to pay taxes. It simplifies the preparation of tax returns and ensures that you receive all the deductions and credits you claim.

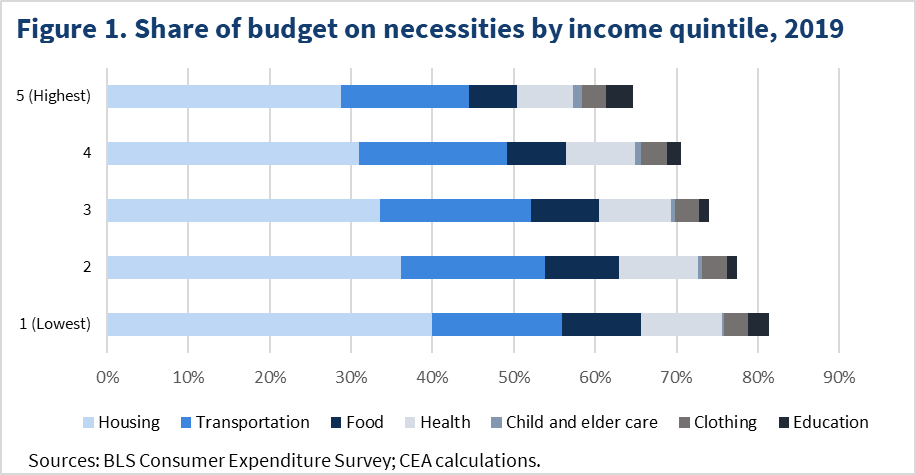

On average, lower- and middle-income families spend a higher share of their budgets on necessities—which we define here as nourishment, clothing, rent, health, education, and child and elder care—and this has been true for decades. Family institutions that are located in the under 60% of money allocation usually spend 4/5 of their income on food and basic commodities. So, even a slight price increase can cause significant financial troubles in their budgets.

At the same time, family institutions with the highest money allocation use only a little bit more than half for such spending, while 35% of income can be spent on whatever they want and cover not only needs but also wants. By the way, such families usually transfer to the "next level" of everyday life and use more qualified and expensive goods. So that even if they face some financial difficulties, they also have cheaper alternatives and some variants to choose from.

The Bottom Line

To sum up, tracking your monthly expenses is an important step towards achieving your financial goals and taking control of your finances. Following the six steps outlined in this article, you can establish a system that works for you and helps you keep track of your income and expenses.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment